This is one of the steps you can't avoid while opening something you are planning to run as a business. Here is you are the boss to make a decision. Think of the starting point: how many of you are going to be the owners? If it's only you, then start with Sole partnership. This is something really suitable for a small start and if you plan to grow you can do so any time. Again, think of how big you are starting and budget and also quick you will grow. Always think about the starting point, look at your plans and see how optimistic your forecast for growing.

The structure you choose will define your legal responsibilities, like:

- the paperwork you must fill in to get started

- the taxes you’ll have to manage and pay

- how you can personally take the profit your business makes

- your personal responsibilities if your business makes a loss

Quite a nice summary of various business structures for you to have an idea and you can obviously google for more detail on each of them. On top, keep in mind your local regulations for each of them and think on what is better and "profitable" for you in first place. Make sure it's legal as well.

The legal structure a business chooses is fundamental to the way it operates. This legal framework determines who shares in the profits and losses, how tax is paid, where legal liabilities rests. It also determines the nature of a business' relationships with business associates, investors, creditors and employees.

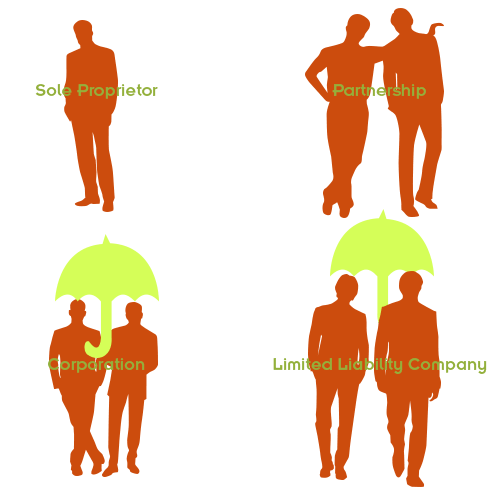

There are three options for a business' legal structure:

(1) Sole Trader

An individual who runs an unincorporated business on his or her own. Sometimes otherwise known as a "sole proprietor" or (in the case of professional services) a"sole practitioner".

The sole trader structure is the most straight-forward option. The individual is taxed under the Inland Revenue's Self-Assessment system, with income tax calculated after deduction for legitimate business expenses and personal allowances. A sole trader is personally liable for the debts of the business, but also owns all the profits.

(2) Partnership

A partnership is an association of two or more people formed for the purpose of carrying on a business. Partnerships are governed by the Partnership Act (1890). Unlike an incorporated company (see below), a partnership does not have a "legal personality" of its own. Therefore the Partners are liable for any debts of the business.

Partner liability can take several forms. General Partners (the usual situation) are fully liable for business debts. Limited Partners are limited to the amount of investment they have made in the Partnership. Nominal Partners also sometimes exist. These are people who allow their names top be used for the benefit of the partnership, usually for remuneration, but they do not get a share of the partnership profits.

The operation of a partnership is usually governed by a "Partnership Agreement". The specific terms of this agreement are determined by the partners themselves, covering issues such as:

- Profit-sharing - normally, partners share equally in the profits; - Entitlement to receive salaries and other benefits in kind (e.g. cars, health insurance) - Interest on capital (the amount invested in the partnership) - Arrangements for the introduction of new partners - Arrangements for retiring partners - What happens when the partnership is dissolved

(3) Incorporated Company

Incorporating business activities into a company confers life on the business as a "separate legal person". Profits and losses are the company's and it has its own debts and obligations. The company continues despite the resignation, death or bankruptcy of management or shareholders. A company also offers the best vehicle for expansion and the provision of outside investors.

There are four main types of company:

(1) Private company limited by shares - members' liability is limited to the amount unpaid on shares they hold

(2) Private company limited by guarantee - members' liability is limited to the amount they have agreed to contribute to the company's assets if it is wound up.

(3) Private unlimited company - there is no limit to the members' liability

(4) Public limited company (PLC) - the company's shares may be offered for sale to the general public and members' liability is limited to the amount unpaid on shares held by them.

Specific arrangements are required for public limited companies. The company must have a name ending with the initials "plc" and have an authorised share capital of at least £50,000 of which at least £12,5000 must be paid up. The company's "Memorandum of Association" must comply with the format in Table F of the Companies Regulations (1985). The company may offer shares and securities to the public. In return for this right to issue shares publicly, a public limited company is subject to much stricter regulation, particularly in relation to the publication of financial information.

The vast majority of companies incorporated in the UK and in other major industrialised countries are private companies limited by shares - "private limited liability companies".

The Office of the Registrar of Companies" (based in Cardiff) maintains a record of all UK private and public companies, their shareholders, directors and financial information. All this information has to be provided by Companies by law and is available to any member of the public for a small charge.

You are starting a company and want to limit your personal liability for the debts of the business as well as the taxes you'll have to pay. This is a common goal for many new business owners. Having a good understanding of how business legal structures work, however, is not so common. So, what are legal structures and what type(s) should you consider? C-corporations, S-corporations, limited liability companies, sole proprietorships, and partnerships are some of the more common options for business legal structures. There are differences and similarities in each that can dramatically affect the future of your company. Failing to structure your business in the most appropriate way (given your goals) can lead to many bad outcomes including:

- Higher than expected tax payments

- Large amounts of administrative work and costs

- Unexpected loss of your personal assets.

No comments:

Post a Comment